Non-clinical healthcare hiring trends, hot jobs & top salaries: 2025

Healthcare industry job growth reached a three-decade high in 2023,1 yet fears of a potential slowdown have both employers and candidates hitting the pause button. While there’s still high demand for clinical roles like nurses and physicians, healthcare organizations, which are closely scrutinizing budgets, are not so quick to backfill administrative roles.

The hospital sector has seen more layoffs and slower hiring,2 while specialty areas like orthopedics, dermatology, and gastroenterology are seeing more growth. These groups are typically private equity-backed firms and management service organizations (MSOs) that provide non-clinical services like billing and collection, IT services, and HR.3

Escalating cyberattacks, a growth in claims volume, inadequate technology, regulatory complexities, and other factors are driving up the demand for accounts receivable (A/R) roles. Filling these positions can ensure that healthcare organizations clear out backlogs and capture revenue, ensuring financial stability and operational efficiency.

“Healthcare organizations are grappling with budget constraints much more now have to really make the case for new non-clinical hires and justify current employees.”

Scott Galanos, Addison Group Sr. Vice President, Healthcare

With trends indicating that 6.5 million healthcare workers may leave their Revenue Cycle Management jobs, in particular, in the next five years4, companies may want to get ahead of the curve and invest in talent during this current cost-effective salary market.

Addison Group has seen that leaders who hesitate to fill open positions should consider the costs of vacancy, which can add up to more than $6,000 a month.5

Looking outside for help

More than half of healthcare executives report that staffing shortages will impact their hiring strategy in the coming year.6 As health systems deal with these workforce challenges and reduced operating margins, some are turning to outsourcing and offshoring of IT, data entry, call center, and customer service work as an alternative to full-time staffing.

While this can reduce costs, there may be a negative impact on data quality, patient experience, and internal employee engagement. Employers who go this route, especially with an offshore firm, should consider a third-party auditor who can ensure that the company’s high standards for customer service and data management are met.

RCM/coding remote roles

There are still many remote jobs available in healthcare nonclinical roles, especially in Revenue Cycle Management (RCM). Medical coders, as well as billing and claims processors, continue to be in demand and easily able to work from home due to advancements in technology. There’s also a growing demand for Clinical Documentation Improvement (CDI) Specialists who are focused on detailed medical documentation to ensure appropriate patient care and billing that correctly meet healthcare regulations. More CDI roles are going totally remote – a major shift as these positions used to be primarily onsite.

The two sides of technology

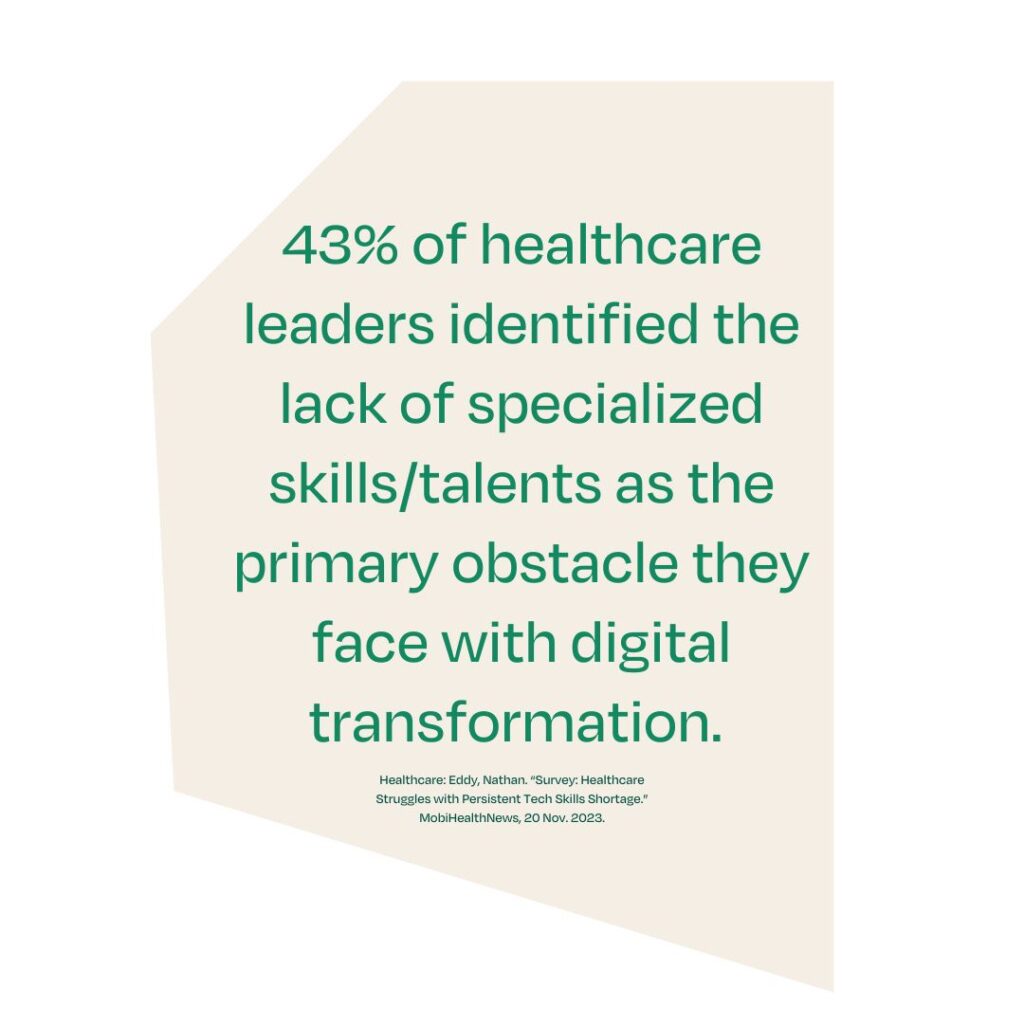

Ask any healthcare leader and they will tell you that they both love and loathe the industry’s growing reliance on technology. They do appreciate the many positive developments that have transformed disease management and business operations, from robotic surgery and nanomedicine to electronic health records, AI, and predictive analytics. While more than one-third of administrative tasks could be automated in the coming years, the digitization wave has created many new positions, such as HIM scanning operations managers and medical coders.7

Yet leaders are also frustrated by increasing cyberattacks which are costing health systems about $10 million per breach.8 Ransomware attacks and data breaches, which have escalated 125% since last year,9 are driving more demand for IT and cybersecurity positions.

With the increase in off-site work in the past few years, recruiters also need to increase security measures to protect automated hiring and onboarding processes. It’s essential to protect the sensitive data of employers and job applicants, which is more frequently becoming the target of cybercriminals.10

Highest-paid non-clinical healthcare salaries

| Director, Case Management | $147,500 |

| Director, Utilization Management | $135,100 |

| Inpatient Services Director | $134,308 |

| Director, Patient Financial Services (CBO) | $130,300 |

| Director, Clinical Documentation Integrity | $129,540 |

| Nurse Manager | $128,208 |

| Director, Patient Access | $125,200 |

| Outpatient Services Director | $121,097 |

| Health Information Management Director | $119,265 |

| Manager, Clinical Documentation Integrity | $104,630 |

| Practice Manager | $98,322 |

| Revenue Cycle Analyst | $93,008 |

| Clinical Validation – Appeals Specialist | $92,700 |

| Clinical Documentation Specialist – Inpatient | $88,761 |

For more valuable insights and national averages of salaries across hundreds of roles in administrative, digital marketing, finance, accounting, healthcare, human resources, and information technology, download your free copy today.

- https://www.healthcaredive.com/news/healthcare-job-growth-three-decade-high-2023-altarum/706552/#:~:text=Since%202020%2C%20ambulatory%20care%20jobs,at%20nursing%20and%20residential%20homes.

- https://www.beckersasc.com/asc-news/where-32-hospitals-health-systems-are-laying-off-employees-in-2024.html

- Addison Group

- https://www.healthtechzone.com/topics/healthcare/articles/2024/05/31/459728-smoothening-healthcare-revenue-cycle-management-addressing-staffing-shortfalls.htm

- https://www.businessmanagementdaily.com/46997/shrm-survey-average-cost-per-hire-is-4129/

- https://www.chiefhealthcareexecutive.com/view/hospitals-could-do-more-outsourcing-in-2024

- https://www.productiveedge.com/blog/the-future-of-healthcare-administration-ai-and-automation

- https://intraprisehealth.com/the-cost-of-cyberattacks-in-healthcare/

- https://www.northcarolinahealthnews.org/2024/07/05/cyberattacks-rural-hospitals-vulnerable/

- Addison Group

- https://www.mobihealthnews.com/news/survey-healthcare-struggles-persistent-tech-skills-shortage